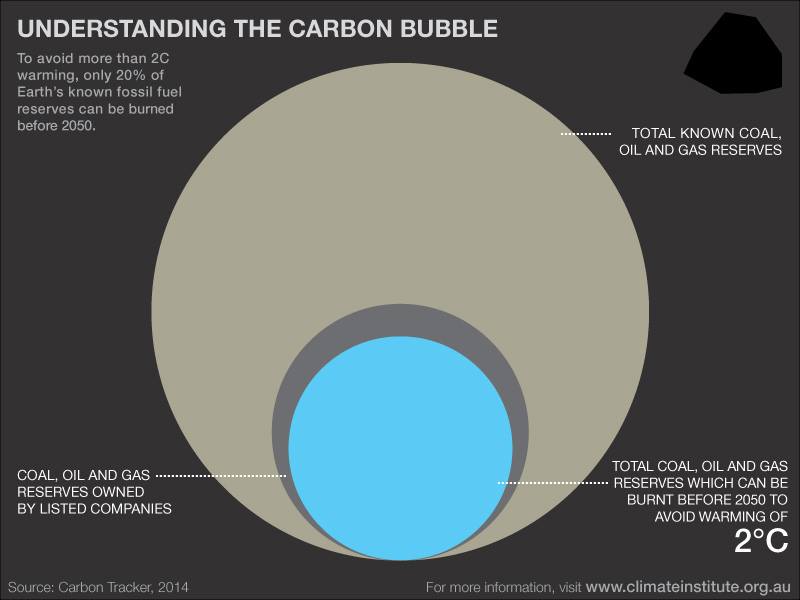

Are the world’s capital markets carrying a carbon bubble? This question related to the fact that there is unburnable carbon, and some of that is owned by listed companies. In terms of carbon there is a clear overhang of fossil fuels beyond what can be burned in a 2°C scenario; there is a lively debate about the financial implications. Some of the issues that have arisen include:

- Are there assets which are being valued in a manner inconsistent with the expected future scenario?

- Does the short-term bias of valuation models mean that the impact of lower-than-expected future demand is largely discounted out at present?

- Is the market capable of pricing in the complex set of factors which could affect demand and price?

- Do large diversified companies (eg mining stocks or oil majors) dilute the impact of a reduction in coal or oil revenues?

- Do current accounting rules capture the value and any potential impairment of assets in a consistent and useful manner, (eg compare mining vs oil; contrast IFRS and US GAAP)?

- If capital expenditure continues to be used to replace reserves could this lead to the inflation of a carbon bubble which would have to be corrected in a scenario of sudden drastic action to prevent dangerous climate change?

More: Carbon Tracker and Wikipedia entry on Carbon Bubble